What Documents Should You Shred After Tax Season?

Tue, Apr 01, 2014

By: Jim Beran

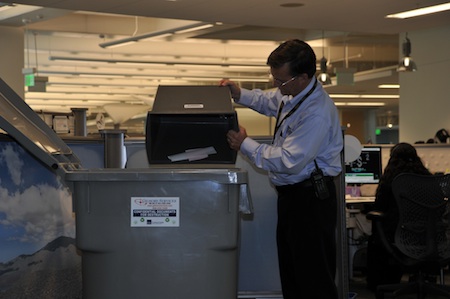

The end of tax season marks the end of collecting and reporting the previous year’s financial statements and is often a breath of fresh air for business owners and the average working American. Filing taxes and accounting for your finances can be time-consuming, so mid-April represents moving forward for the year. Once the returns are processing, many people struggle to determine what to do with all of the paper documents accumulated over the course of a year and beyond. Take a look at which documents to shred and purge after tax season.

Clear clutter and consolidate

Free your office space of clutter after tax season by understanding when you can securely destroy certain documents. In general, The IRS may audit a person’s taxes for up to three years after the filing deadline, so the recommendation for off-site document storage is four years before having a document shredding company destroy the information.

Remember that safe destruction is not just necessary for confidential paper documents. Personal or financial data stored on discs, CDs, flash drives or other digital sources that you no longer need should be handled by a company skilled in digital and hard drive destruction.

What should you hold on to?

Keep paper documents when it comes to itemized deductions. If you own things which are subject to depreciation, like furniture and equipment used for your business, you should keep receipts for as long as the items are depreciating. Also, records related to real estate should be kept for as long as you own the property. If you are unsure whether or not to save a document, it is best to err on the side of caution and save documents that can be or have been deducted for tax purposes over the past few years.

A final tip: Consolidate information when possible and clear you home or office of clutter with secure off-site document storage. Trying to store years of records at home or in your storage room be disastrous if not properly managed.

Look ahead

Make it easier on yourself by loosely planning for the next tax season now. This way, when the time rolls around next year, you'll have less of a burden. Remember to save any relevant personal or business-related receipts, both paper and digital. Beyond just saving this information, create a digital file or a paper binder with the records clearly organized for easy reference next year.

Consider document scanning to create digital records for your W-2s, 1099s, bank statements and other essential supporting documents. For more back up, have a CD copy of your documents in case files are lost or stolen.

Is it time to manage your records this tax season? Give us a call to see how we can help you manage, access, scan and destroy documents at the right time.