4 Crimes Your Business Could Avoid with a Secure Shredding Service

Wed, Jul 22, 2015

By: Jim Beran

Running a business fairly and ethically can be a real challenge in an unpredictable and competitive marketplace. Walking the tightrope between legal and illegal practices can make the job far more stressful.

Often, business owners and managers put themselves in a compromised position without even realizing it. Even if they are not actively trying to do anything illegal, simply leaving themselves open to criminal activity, or failing to comply with unfamiliar laws can cause issues.

In most cases, these oversights can be rectified by applying some simple records management tools. Below are four potentially business-destroying crimes that you can avoid by working with a secure shredding service.

Identity Theft

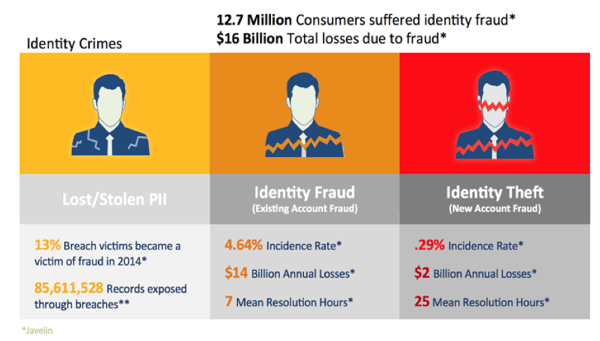

This is a big threat that can affect nearly any business that keeps paper records including identifiable personal information about their customers. 12.7 million Americans became victims of some form of identity theft or fraud last year, resulting in an estimated $16 billion in losses.

If your organization maintains paper records including customer information and a breach is reported that can be traced back to you, it can cause serious problems for your business. One of those problems could be a huge financial burden if a lawsuit is brought against your company by the victims of fraud.

By working with a secure shredding professional, this becomes a null issue: all of your paper records are either destroyed directly on your premises or at a secure records management facility.

HIPAA Violations

If your business hinges in any way on medical or health-related services, you are likely responsible to comply with the Health Information Portability and Accountability Act (HIPAA). Among other things, this act requires companies that have access to personally identifiable information about individuals must protect this information and cannot share it with others without the individual’s express permission.

This isn’t limited just to doctor’s offices or hospitals, but it also includes insurance companies, medical billing providers, and anyone else who may potentially obtain this information in written form. As outlined at HIPAA.com, an online training source, the penalties for violating HIPAA are potentially very severe, including tens of thousands of dollars in fines and even jail time.

If every piece of paper you handle with identifiable information on it is securely shredded, you don’t need to worry about violating HIPAA by accident.

Gramm-Leach-Bliley

The Gramm-Leach-Bliley Act (GBLA) of 1999 was designed to prevent financial institutions from sharing any private information about their consumers with anyone outside the organization. It applies to banks, credit unions, insurance companies, and brokerage firms.

The GBLA has three main parts: the Financial Privacy Rule, the Safeguard Rule, and the Pretexting Provisions. The Safeguard Rule specifically requires financial institutions to use any and all reasonable means to safeguard their consumers’ private information, including securely shredding paper documents containing this information.

An online legal resource, lawyers.com, provides the following list of penalties faced by companies that knowingly or unknowingly violate the GBLA:

- A financial institution can be fined up to $100,000 for each violation

- The officers and directors of the financial institution can be fined up to $10,000 for each violation

- Criminal penalties include imprisonment for up to 5 years, a fine, or both

- If the GLBA is violated at the same time that another federal law is violated, or if the GLBA is violated as part of a pattern of any illegal activity involving more than $100,000 within a 12-month period, the violator’s fine will be doubled and he or she will be imprisoned for up to 10 years

FACTA

The Fair and Accurate Credit Transaction Act (FACTA) was designed to reduce fraud by requiring all businesses (and individuals) to properly dispose of all personally identifiable consumer information.

There are no limits in regard to type of business, or type of information. If you dispose of material that is later used by criminals to perpetrate fraud against a consumer, you can be held liable for your part in the process.

The FACTA Disposal Rule specifies secure shredding as one of the preferred methods for disposing of consumer information, and it outlines severe penalties for violations, including fines in the thousands of dollars per consumer effected.

In all these cases, a secure shredding service can offer you peace of mind and protection from the heavy penalties of non-compliance. For more information on how affordable and effective secure shredding can be, contact us to learn more.

Photo courtesy of Victor via Flickr (https://www.flickr.com/photos/v1ctor/)